Discover the power of compound interest and its significance in wealth creation. Learn how to explain this financial concept to your kids effectively. Read on for a comprehensive guide on compound interest, its benefits, and practical tips to teach your children about financial literacy.

Introduction

Compound interest is a fundamental financial concept that plays a crucial role in wealth creation over time. It has the potential to transform modest savings into substantial assets through the power of time and consistent growth. Understanding compound interest is essential for anyone seeking to achieve their long-term financial goals and secure their financial future. In this comprehensive article, we will delve deep into the concept of compound interest, explore its importance in wealth creation, and provide practical advice on how to explain this complex idea to your kids in a way that is easy to understand.

The Definition of Compound Interest

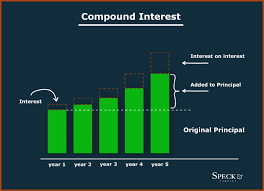

At its core, compound interest refers to the interest earned not only on the initial principal amount but also on the accumulated interest over time. Unlike simple interest, where interest is calculated solely based on the principal, compound interest allows your money to grow exponentially. As the interest is added to the principal, the total amount grows larger, resulting in higher interest earnings in subsequent periods.

Understanding Compound Interest with Real-World Examples

To better grasp the concept of compound interest, let’s consider a real-world example. Imagine you deposit $1,000 in a savings account with an annual interest rate of 5%. At the end of the first year, you would earn $50 in interest, resulting in a total balance of $1,050. In the second year, the interest is calculated not only on the initial $1,000 but also on the additional $50 from the first year. As a result, you would earn $52.50 in interest, bringing your total balance to $1,102.50. This process continues, and the interest earned keeps compounding, leading to significant growth in your savings over time.

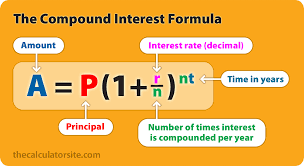

The Formula for Compound Interest

A = P(1 + r/n)^(nt)

- A is the future value of the investment/loan, including interest

- P is the principal amount (initial investment/loan amount)

- r is the annual interest rate (expressed as a decimal)

- n is the number of times that interest is compounded per year

- t is the number of years the money is invested or borrowed for

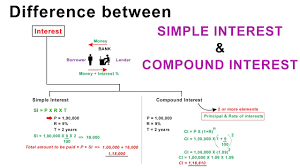

The Difference Between Compound Interest and Simple Interest

The key difference between compound interest and simple interest lies in the frequency of interest calculations. With compound interest, interest is calculated and added to the principal at regular intervals, leading to exponential growth. On the other hand, simple interest is calculated solely based on the initial principal amount and remains constant over time.

The Power of Time in Compound Interest

One of the most critical factors in maximizing the benefits of compound interest is time. The longer your money remains invested, the greater the compounding effect. Starting early and letting your investments grow over several years can result in substantial wealth accumulation. This is why financial advisors often emphasize the importance of starting to invest as soon as possible.

The Importance of Compound Interest in Wealth Creation

Compound interest is a powerful tool for wealth creation and long-term financial success. Let’s explore some of the key reasons why compound interest is essential:

1. Accelerated Growth of Investments

As mentioned earlier, compound interest allows your investments to grow at an accelerated rate. By reinvesting your earnings, your money has the potential to work for you, resulting in exponential growth over time. This compounding effect can significantly boost the overall returns on your investments.

2. Building Retirement Savings

For retirement planning, compound interest is a valuable asset. By consistently contributing to retirement accounts, such as 401(k)s or IRAs, and allowing the money to grow through compounding, individuals can secure a comfortable retirement lifestyle.

3. Beating Inflation

Inflation erodes the purchasing power of money over time. Compound interest helps counter the impact of inflation by generating returns that outpace the rising cost of living. This ensures that your money retains its value and continues to grow despite inflationary pressures.

4. Financial Independence and Freedom

The power of compound interest can lead to financial independence and freedom. As your investments grow, they can generate passive income, providing you with more financial flexibility and the ability to pursue your passions and dreams without financial constraints.

5. Leaving a Legacy

Compound interest not only benefits you during your lifetime but can also create a lasting legacy for your loved ones. By passing on your accumulated wealth to future generations, you can positively impact their lives and provide them with opportunities for a better future.

Accumulating Wealth Through Compound Interest

Now that we understand the importance of compound interest, let’s explore some strategies for accumulating wealth through this powerful financial tool:

1. Start Early and Stay Consistent

The key to maximizing the benefits of compound interest is to start early and remain consistent with your investments. The longer your money remains invested, the more time it has to compound and grow. Even small, regular contributions can make a significant difference over time.

2. Invest in Diverse Assets

Diversification is a crucial aspect of any successful investment strategy. By spreading your investments across various asset classes, such as stocks, bonds, real estate, and mutual funds, you can reduce risk and enhance the potential for higher returns.

3. Reinvest Dividends and Interest

When you invest in dividend-paying stocks or interest-bearing accounts, consider reinvesting the earnings back into your portfolio. This allows your money to keep compounding and generates additional growth.

4. Avoid Unnecessary Withdrawals

While emergencies may arise, try to avoid unnecessary withdrawals from your investment accounts. Each time you withdraw, you interrupt the compounding process, potentially reducing your overall returns.

5. Seek Professional Financial Advice

For complex investment decisions or retirement planning, consider seeking advice from a qualified financial advisor. A professional can help you develop a personalized investment plan that aligns with your financial goals and risk tolerance.

Long-Term Investment Strategies

When it comes to long-term investment strategies, two approaches stand out as particularly effective in harnessing the power of compound interest:

1. Dollar-Cost Averaging

Dollar-cost averaging is an investment strategy that involves making regular contributions to your investment accounts, regardless of market conditions. By investing a fixed amount at regular intervals, you buy more shares when prices are low and fewer shares when prices are high. This strategy smooths out the impact of market volatility and takes advantage of the potential for lower average costs over time.

2. Buy and Hold Strategy

The buy and hold strategy involves selecting high-quality investments and holding onto them for an extended period, regardless of short-term market fluctuations. By maintaining a long-term perspective and not succumbing to the temptation of frequent trading, investors can benefit from compound interest and achieve better returns.

Diversification and Compound Interest

Diversification is a vital aspect of any investment strategy, especially concerning compound interest. By diversifying your investment portfolio, you spread your risk across different assets, industries, and regions, reducing the impact of any individual investment’s performance on your overall wealth. This approach helps protect your investments from severe market downturns and enhances the potential for long-term growth.

When it comes to compound interest, diversification plays a crucial role in sustaining steady and reliable returns. As different assets within your portfolio generate earnings, those earnings contribute to the compounding effect, leading to accelerated growth over time. Moreover, diversification allows you to take advantage of opportunities across various sectors, ensuring your investments are well-positioned for potential growth and mitigating the impact of economic fluctuations.

The Role of Compound Interest in Retirement Planning

Retirement planning is a vital aspect of financial security, and compound interest can significantly impact the outcome of your retirement nest egg. With the power of time and consistent contributions, compound interest can make a significant difference in the size of your retirement savings.

One popular retirement savings vehicle that utilizes compound interest is the Individual Retirement Account (IRA). IRAs come in various forms, such as Traditional IRAs and Roth IRAs, each offering unique tax advantages. By contributing regularly to your IRA over the course of your career, your money has more time to grow through compound interest, potentially resulting in a more comfortable retirement lifestyle.

Additionally, employer-sponsored retirement plans like 401(k)s often include matching contributions from employers. These matching contributions are essentially free money that can also benefit from the compounding effect, boosting your retirement savings even further.

Compound Interest in the Context of Debt

Compound interest not only benefits savers and investors but also impacts borrowers, especially when it comes to debt. Loans and credit cards often come with compounded interest rates, and if not managed carefully, debt can quickly spiral out of control.

When you carry a balance on a credit card, for example, the interest compounds on the unpaid balance. The longer it takes to pay off the debt, the more interest you accumulate, making it harder to get out of debt.

To minimize the negative impact of compound interest on debt, consider implementing these strategies:

1. Pay More than the Minimum

Whenever possible, pay more than the minimum required payment on loans and credit cards. By making extra payments, you reduce the principal balance faster, which, in turn, reduces the amount of interest that compounds.

2. Prioritize High-Interest Debts

If you have multiple debts, focus on paying off the ones with the highest interest rates first. This approach will save you more money in the long run, as you’ll be reducing the compounding effect of high-interest debt.

3. Consolidate Debts

Consider consolidating multiple debts into a single loan with a lower interest rate. This can make it easier to manage your debt and potentially save on interest payments.

4. Avoid New Debt

While paying off existing debt, avoid taking on new debt whenever possible. Each new debt adds to the compounding effect, making it more challenging to achieve financial freedom.

Teaching Kids About Money and Compound Interest

Financial education is a valuable gift to give your children, and compound interest is a fundamental concept that can set them on the path to financial success. Teaching kids about money from a young age instills good financial habits and prepares them for the financial challenges they will face as adults. Here are some age-appropriate approaches to explain compound interest to kids:

1. Start Early and Make It Fun

Introducing money concepts to young children can be as simple as using coins and piggy banks. Show them how saving money in a piggy bank can grow over time, and celebrate their milestones as their savings increase.

2. Use Everyday Situations

Incorporate money lessons into everyday situations. For instance, when your child receives money as a gift, discuss the importance of saving a portion and letting it grow through compound interest.

3. Hands-On Learning with Savings Accounts

When your child is old enough, consider opening a savings account in their name. Involve them in tracking their deposits and watching the interest accumulate.

4. Encourage Goal Setting

Teach your kids about setting financial goals, such as saving for a special toy or outing. Discuss how compound interest can help them reach their goals faster when they consistently save their money.

5. Demonstrate the Magic of Compound Interest

Use online compound interest calculators to demonstrate the power of compounding. Show your kids how even a small monthly contribution can grow into a substantial amount over time.

Games and Activities to Teach Compound Interest

Learning about compound interest doesn’t have to be boring. There are several games and activities that can make financial education fun and engaging for kids:

1. The Savings Challenge

Challenge your kids to save a certain amount of money and track their progress. Offer small rewards as they reach specific savings milestones, motivating them to continue saving.

2. The Investment Game

Create a simple investment game where your kids can pretend to invest in fictional stocks or businesses. Track the performance of their investments over time, allowing them to see the power of compound interest in action.

3. The Lemonade Stand

Encourage your kids to set up a lemonade stand or small business. Help them calculate their expenses and profits, demonstrating how reinvesting earnings can lead to compound growth.

Common Questions Kids Ask About Money

As you discuss money and compound interest with your kids, they may have various questions. Here are some common questions and their answers

Q: What is compound interest?

Compound interest is when the interest on money not only accumulates on the initial amount but also on the interest earned over time. This allows your money to grow faster and become a more significant amount in the future.

Q: How does compound interest work?

Compound interest works by adding interest to the principal amount regularly. As time goes on, the interest is calculated on the new total, including the previously earned interest.

Q: Why is compound interest important?

Compound interest is crucial because it helps your savings grow faster, which can lead to more significant wealth over time. It rewards consistent saving and allows your money to work for you.

Q: Is compound interest beneficial for everyone?

Yes, compound interest is beneficial for everyone who saves or invests money. It’s a powerful tool for wealth creation and financial security.

Q: How does compound interest impact savings and investments?

Compound interest can significantly impact savings and investments by accelerating their growth over time. The longer your money remains invested, the more it benefits from compounding.

Q: Can compound interest lead to financial freedom?

Absolutely. By consistently saving and investing, compound interest can lead to financial freedom and independence. It allows you to build wealth and achieve your financial goals.

Conclusion

In conclusion, compound interest is a financial concept that holds immense power in wealth creation and financial success. By understanding how compound interest works and harnessing its potential through long-term investments, individuals can secure their financial future and achieve their dreams. Additionally, teaching kids about money and compound interest from a young age empowers them with essential financial skills and sets them on the path to financial independence.

So, start early, stay consistent, and let the magic of compound interest work in your favor. With careful planning and smart financial decisions, you can build a prosperous future

for yourself and your loved ones. Remember, the key is to remain patient and disciplined in your financial journey.

Financial education is a gift that keeps on giving, and by passing down the knowledge of compound interest to your children, you equip them with a valuable life skill. As they grow older, they will have a better understanding of the importance of saving, investing, and making sound financial decisions.

As you continue to guide your children in their financial literacy journey, remember to make learning about money fun and engaging. Utilize games, activities, and real-life examples to reinforce the concept of compound interest. By making the learning process enjoyable, you foster a positive attitude towards money and finance in your children.

In addition to teaching your kids about compound interest, don’t forget to lead by example. Demonstrate responsible financial habits, such as budgeting, saving, and investing. Children learn by observing the behavior of their parents and caregivers, so showcasing good financial practices will have a lasting impact on their financial behavior.

As your children grow older and their understanding of money and compound interest deepens, encourage them to set financial goals. Whether it’s saving for a special purchase, funding their college education, or investing for their future, goal-setting instills a sense of purpose and responsibility in managing money.

Moreover, involve your children in household financial discussions when appropriate. Discuss budgeting, saving for vacations or major expenses, and planning for the future. This level of transparency and inclusion in financial matters helps them feel valued and responsible, laying the foundation for future financial independence.

In conclusion, compound interest is a concept that has the potential to transform financial futures and create a path to long-term wealth. By harnessing the power of time and consistent growth, compound interest allows your money to work for you, generating significant returns over the years. Whether you’re investing for retirement, saving for your children’s education, or building a rainy-day fund, understanding and leveraging compound interest is key.

Teaching kids about money and compound interest is equally important, as it empowers them with essential financial skills from an early age. Through age-appropriate approaches, interactive learning, and leading by example, parents can instill the value of saving and investing in their children, setting them up for financial success in the future.

So, take the time to educate yourself and your children about compound interest and the benefits it offers. Embrace the power of compound interest, make smart financial decisions, and pave the way for a prosperous and secure financial future for you and your family.

Q: What is compound interest?

Compound interest is a financial concept that refers to the interest earned not only on the initial principal amount but also on the accumulated interest over time. This compounding effect leads to exponential growth, allowing your money to grow faster and become a more significant amount in the future.

Q: How does compound interest work?

Compound interest works by adding interest to the principal amount regularly. As time goes on, the interest is calculated on the new total, which includes the previously earned interest. This continuous cycle of earning interest on interest leads to accelerated growth of your savings or investments.

Q: Why is compound interest important?

Compound interest is crucial because it has the potential to significantly impact your financial future. By allowing your money to grow through compounding over time, you can achieve long-term financial goals, build wealth, and secure your financial independence

Q: Is compound interest beneficial for everyone?

Yes, compound interest is beneficial for everyone who saves or invests money. Whether you’re an individual saving for retirement, a parent setting up a college fund for your child, or an investor growing your wealth, compound interest can work in your favor.

Q: How does compound interest impact savings and investments?

Compound interest has a profound impact on savings and investments by accelerating their growth over time. The longer your money remains invested, the more it benefits from compounding, leading to substantial returns over the years.

Q: Can compound interest lead to financial freedom?

Absolutely. By consistently saving or investing and letting the power of compounding work in your favor, you can achieve financial freedom and independence. Compound interest can help you build a solid financial foundation and achieve your life goals.

Q: How can I maximize the benefits of compound interest?

To maximize the benefits of compound interest, consider starting to save or invest as early as possible. The longer your money has to compound, the more significant the impact. Additionally, stay consistent with your contributions, diversify your investments, and reinvest any earnings to let your money grow.

Q: How do I calculate compound interest?

The formula for calculating compound interest is A = P(1 + r/n)^(nt), where:

A is the future value of the investment/loan, including interest

P is the principal amount (initial investment/loan amount)

r is the annual interest rate (expressed as a decimal)

n is the number of times that interest is compounded per year

t is the number of years the money is invested or borrowed for

Q: Is compound interest the same as simple interest?

No, compound interest and simple interest are different. With simple interest, interest is calculated solely based on the initial principal amount and remains constant over time. In contrast, compound interest includes the interest earned over time, leading to exponential growth.

Q: How can I explain compound interest to my kids?

Explaining compound interest to kids can be done through age-appropriate approaches. Use everyday situations, such as saving for a toy, and show them how their money can grow over time through compounding. Make it fun with games and activities that involve saving and investing, and let them see the magic of compound interest through real-life examples.

Remember that starting early is key to maximizing the benefits of compound interest. By introducing financial concepts like compound interest to your kids from a young age, you set them on the path to financial literacy and a secure financial future.

Q: How can I incorporate compound interest lessons into everyday situations for my kids?

Incorporating compound interest lessons into everyday situations for kids can be simple and effective. For example, when your child receives money as a gift or allowance, encourage them to put a portion of it into a piggy bank or a savings jar. Regularly discuss their savings progress and show them how their money can grow over time through compounding. Additionally, when planning family outings or purchases, involve your children in the budgeting process and demonstrate how saving for these activities can lead to more enjoyable experiences.

Q: What are some interactive ways to teach kids about compound interest?

Interactive learning is an excellent way to teach kids about compound interest. Consider using games or apps that simulate saving and investing scenarios, where they can witness the power of compound interest firsthand. For example, you can use financial education board games or online simulations that allow your kids to invest virtual money and see how it grows over time.

Q: At what age should I start teaching my kids about compound interest?

You can start introducing basic financial concepts, including compound interest, to children as young as five or six years old. Use simple explanations and age-appropriate examples to make it relatable and engaging. As they grow older and their understanding of math improves, you can introduce more complex ideas and calculations related to compound interest.

Q: How can I make learning about money and compound interest fun for my kids?

Making learning about money and compound interest fun for kids involves creativity and interactive activities. Use games, role-playing scenarios, and hands-on experiences to teach financial concepts. Organize a pretend “store” where your children can buy and sell items using play money, and discuss how saving their play money can lead to more significant purchases in the future.

Q: What are some real-life examples of compound interest that kids can relate to?

Real-life examples of compound interest that kids can relate to include saving money for a toy, video game, or other desired item. Show them how consistently saving a little bit of money each week can lead to having enough to buy the item sooner than expected due to the compounding effect.

Q: How can I instill good financial habits in my kids to complement their understanding of compound interest?

Instilling good financial habits in your kids goes hand in hand with teaching them about compound interest. Encourage them to set financial goals, such as saving a certain amount each month or contributing a portion of their allowance to a savings account. Emphasize the value of delayed gratification and the importance of making thoughtful spending decisions.

Q: How can I explain the concept of compound interest in the context of borrowing money?

To explain compound interest in the context of borrowing money, use relatable examples such as borrowing money to buy a bike or a game console. Discuss how paying off the borrowed amount in small installments with interest can result in paying more in total than the initial loan. This demonstrates the importance of understanding interest rates and the cost of borrowing.

Q: Can compound interest be applied to any type of financial account?

Yes, compound interest can be applied to various financial accounts, including savings accounts, investment accounts, and retirement accounts like IRAs and 401(k)s. Different types of accounts may have different compounding frequencies (e.g., annually, quarterly, monthly), affecting how often interest is added to the balance.

Q: How can I motivate my kids to save and invest with the knowledge of compound interest?

Motivating kids to save and invest can be achieved through goal-setting and positive reinforcement. Encourage them to set short-term and long-term financial goals, such as saving for a special outing or a future purchase. Celebrate their achievements and progress along the way, and use real-life examples of people who have benefited from compound interest to inspire and motivate them.

Teaching kids about compound interest is an invaluable life skill that sets the foundation for their financial future. By explaining financial concepts in fun and interactive ways, you equip them with the tools they need to make sound financial decisions and achieve their goals. As parents and caregivers, your guidance and support in their financial education will leave a lasting impact on their lives.